Turkey held general elections on the following dates (not included before 2002):

| date | election |

|---|---|

| Nov 3, 2002 | General |

| Jul 22, 2007 | General |

| Jun 12, 2011 | General |

| Jun 07, 2015 | General |

| Nov 01, 2015 | General |

| Jun 24, 2018 | General |

Since the AKP has been ruling Turkey since 2002, this work will actually be the government’s performance.

You can download the post32_1.xlsx and post32_2.xlsx files here or go to the CBRT’s website.

bist100 <- readxl::read_excel("data1.xlsx") %>%

mutate(date = lubridate::dmy(date))

election_dates <- c("2002-11-03",

"2007-07-22",

"2011-06-12",

"2015-06-07",

"2015-11-01",

"2018-06-24")

ggplot(bist100, aes(x = date, y = close)) +

geom_line() +

geom_vline(xintercept = as.Date(election_dates), linetype = "dotdash", color = "red", size = 1) +

ggthemes::theme_fivethirtyeight() +

theme(axis.text = element_text(size = 20)) +

scale_y_continuous(labels = scales::comma)

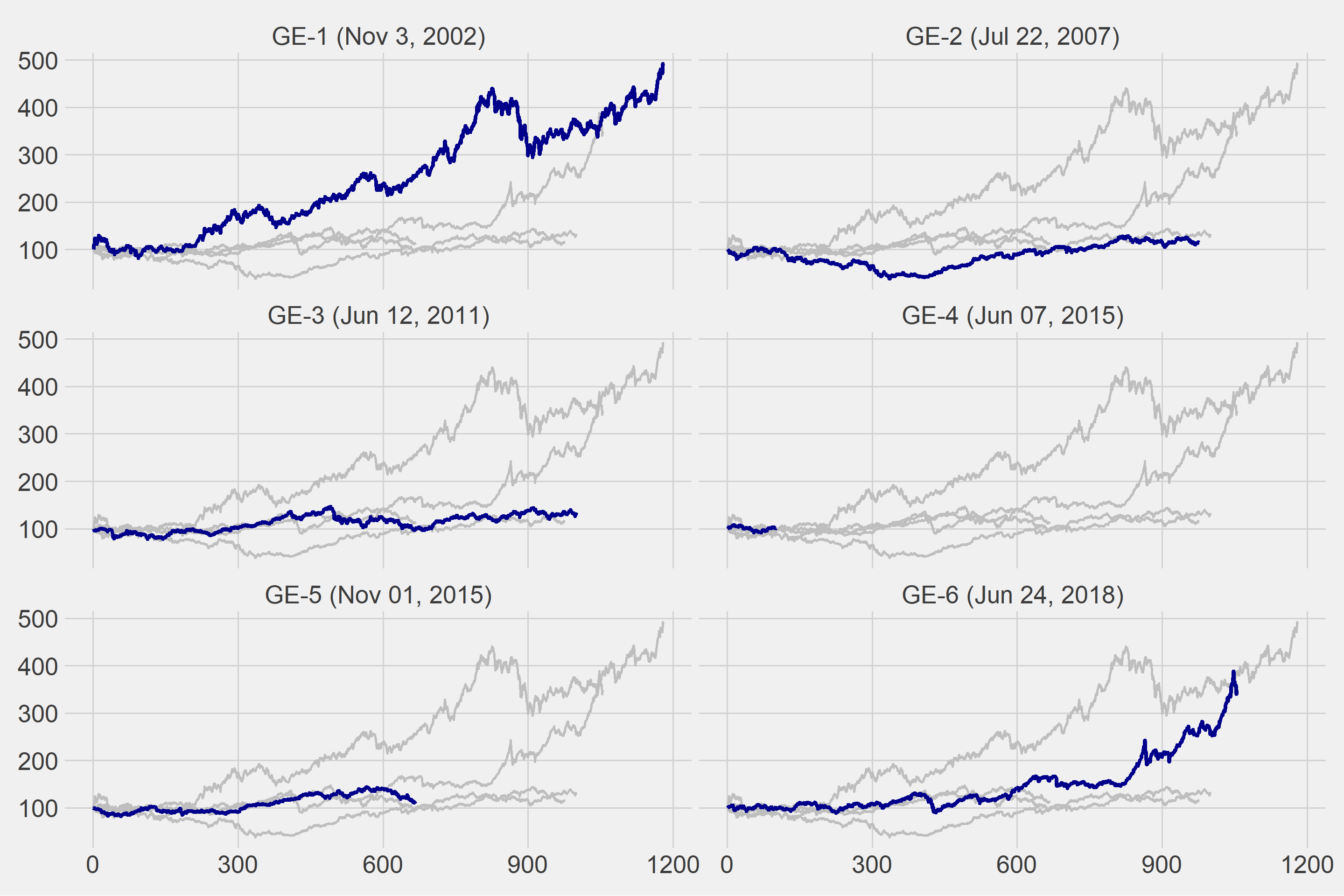

We’ll create indices starting with 100 using each election date as a start date.

# Groups

bist100 <- bist100 %>%

mutate(

election = case_when(

date >= as.Date("2002-11-03") & date < as.Date("2007-07-22") ~ "GE-1 (Nov 3, 2002)",

date >= as.Date("2007-07-22") & date < as.Date("2011-06-12") ~ "GE-2 (Jul 22, 2007)",

date >= as.Date("2011-06-12") & date < as.Date("2015-06-07") ~ "GE-3 (Jun 12, 2011)",

date >= as.Date("2015-06-07") & date < as.Date("2015-11-01") ~ "GE-4 (Jun 07, 2015)",

date >= as.Date("2015-11-01") & date < as.Date("2018-06-24") ~ "GE-5 (Nov 01, 2015)",

date >= as.Date("2018-06-24") ~ "GE-6 (Jun 24, 2018)"

)

)

Done!

ggplot(master, aes(x = t, y = indices)) +

geom_line(data = master %>% rename(election2 = election),

aes(group = election2), color = "gray", size = 1) +

geom_line(color = "dark blue", size = 1.5) +

ggthemes::theme_fivethirtyeight() +

theme(strip.text = element_text(size = 20),

axis.text = element_text(size = 20)) +

facet_wrap(~election, ncol = 2)

Let’s calculate the returns on a group basis.

| election | return |

|---|---|

| GE-1 (Nov 3, 2002) | 158.5 |

| GE-2 (Jul 22, 2007) | 13.6 |

| GE-3 (Jun 12, 2011) | 25.5 |

| GE-4 (Jun 07, 2015) | 2.0 |

| GE-5 (Nov 01, 2015) | 13.6 |

| GE-6 (Jun 24, 2018) | 124.9 |

The best performance was demonstrated between the elections in 2002 and 2007 as seen in the table above. The period following the 2018 general elections has the second best performance. Yay!

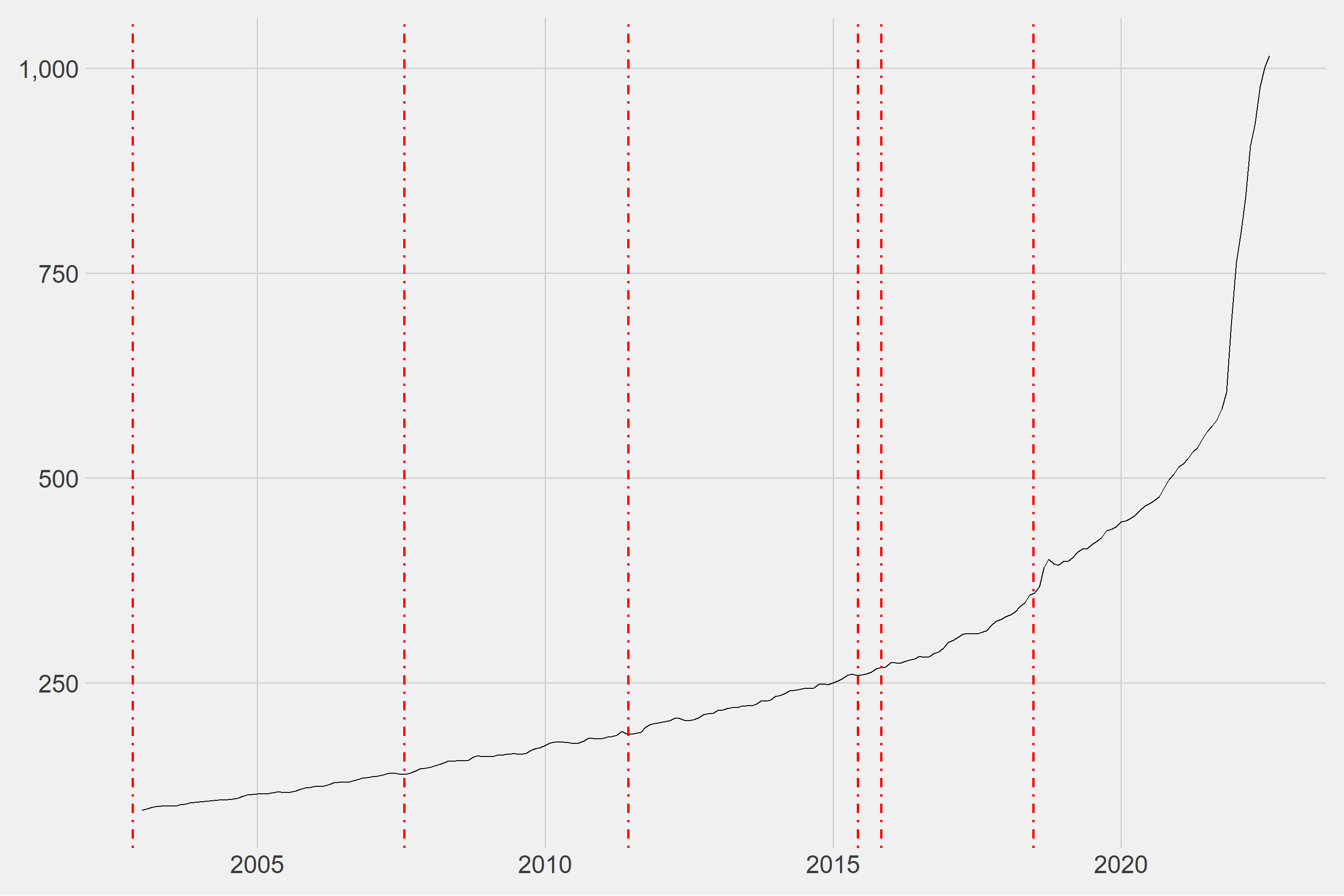

It’s too soon to celebrate! See below for the CPI values during the time of the ruling party!

cpi <- readxl::read_excel("data2.xlsx") %>%

mutate(

date = lubridate::ymd(paste0(date,"-",1))

)

ggplot(cpi, aes(x = date, y = cpi)) +

geom_line() +

geom_vline(xintercept = as.Date(election_dates), linetype = "dotdash", color = "red", size = 1) +

ggthemes::theme_fivethirtyeight() +

theme(axis.text = element_text(size = 20)) +

scale_y_continuous(labels = scales::comma)

Because CPI values are published on a monthly basis, we must convert the stock market index to a monthly basis. The following formulas can be used to perform calculations.

\(P_t^{real} = P_t / CPI_t\)

\(r_t^{real} = ln(1 + R_t^{real})\)

\(R_t^{real} = (P_t^{real} - P_{t-1}^{real}) / P_{t-1}^{real}\)

bist100_monthly <- readxl::read_excel("data1.xlsx") %>%

mutate(date = lubridate::dmy(date),

year = lubridate::year(date),

month = lubridate::month(date)) %>%

group_by(year,month) %>%

summarise(close = mean(close)) %>%

ungroup() %>%

mutate(date = as.Date(paste0(year,"-",month,"-",1))) %>%

select(date,close) %>%

mutate(

election = case_when(

date >= as.Date("2002-11-01") & date < as.Date("2007-07-01") ~ "GE-1 (Nov 3, 2002)",

date >= as.Date("2007-07-01") & date < as.Date("2011-06-01") ~ "GE-2 (Jul 22, 2007)",

date >= as.Date("2011-06-01") & date < as.Date("2015-06-01") ~ "GE-3 (Jun 12, 2011)",

date >= as.Date("2015-06-01") & date < as.Date("2015-11-01") ~ "GE-4 (Jun 07, 2015)",

date >= as.Date("2015-11-01") & date < as.Date("2018-06-01") ~ "GE-5 (Nov 01, 2015)",

date >= as.Date("2018-06-01") ~ "GE-6 (Jun 24, 2018)"

)

) %>%

left_join(cpi, by = "date") %>%

na.omit() %>%

mutate(

new_close = close / cpi, .before = close

) %>%

select(-close,-cpi)

ggplot(master2, aes(x = t, y = indices)) +

geom_line(data = master2 %>% rename(election2 = election),

aes(group = election2), color = "gray", size = 1) +

geom_line(color = "dark blue", size = 1.5) +

ggthemes::theme_fivethirtyeight() +

theme(strip.text = element_text(size = 20),

axis.text = element_text(size = 20)) +

facet_wrap(~election, ncol = 2)

| election | return |

|---|---|

| GE-1 (Nov 3, 2002) | 108.0 |

| GE-2 (Jul 22, 2007) | -7.9 |

| GE-3 (Jun 12, 2011) | -2.1 |

| GE-4 (Jun 07, 2015) | -6.5 |

| GE-5 (Nov 01, 2015) | -1.5 |

| GE-6 (Jun 24, 2018) | 7.0 |

When we consider inflation, we can see how the gap between the best return and the current period widens!